TurboTax is Hiding Price Increase

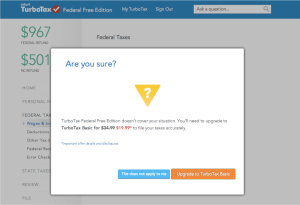

TurboTax, the leading do-it-yourself tax software by Intuit, has caused an uproar with their customers claiming shady tactics of “price gouging” & “bait & switch”. Intuit has removed popular tax forms from their Basic & Deluxe programs, forcing clients to upgrade their software by at least $30 in order to have access to the same forms that were in last year’s programs:

Starting this year, people who prepare their taxes on a personal computer can’t use TurboTax Deluxe if they want to electronically file common tax forms, including Schedule C for a business, Schedule D for capital gains and losses or Schedule E for rental property. Instead, they must upgrade to the Premier or Home & Business versions—which cost up to $30 more than the $50 Deluxe version as of Friday.

Customers with simpler returns face a similar issue: They can no longer use TurboTax Basic if they want to itemize their deductions on Schedule A, such as mortgage interest or charitable donations, instead of claiming the standard deduction of $6,200 for a single filer or $12,400 for a married couple. Now, they will need to upgrade to TurboTax Deluxe, which costs up to $30 more than the $20 Basic.

It’s not so much that TurboTax raised their prices, it was the manner in which they did it. They didn’t give any “heads up” to their customers who expected the same product to contain the same forms. It was not until users tried to add their usual tax forms that they found out they had to pay more to get the same product as last year. In fact, TurboTax has hundreds of negative reviews on a popular Consumer Affairs website, and currently has a 1 star rating (out of 5 stars) as a result of these backdoor tactics.

“The company seems intent on fleecing the customer by increasing the price with no product improvement,” says Don Rickelman, a retired entrepreneur in Naples, Fla. In the past, he says, he has used TurboTax Deluxe to report his investments, but now, like many other users, he is considering alternatives.

Over the last 5 years or so since the onset of the Great Recession, many taxpayers have been flocking to inexpensive DIY tax software as a way to save some much needed cash. However, with a decrease in unemployment coupled with the sharp decrease in Oil, many taxpayers have less time and a little extra cash in their pocket this year as opposed to years past. This could be good news for the Professional Tax Preparing industry this year; especially when it has been shown that taxpayers who prepare their own returns frequently make mistakes & miss out on deductions/credits that reduce their refunds. With an unresponsive IRS, delayed refunds and the uncertainty surrounding the new health care tax forms & penalties, this is the year to have an R&G Brenner Tax Professional on your team!

Source: Wall Street Journal